Gavin Lane, CLA president, said: "This change will come as an enormous relief to thousands of family farms across the country who faced seeing their businesses taxed out of existence. The Government deserves credit for recognising the flaws in the original policy and changing course. However, this announcement only limits the damage – it does not eradicate it entirely."

Agricultural Property Relief (APR) and Business Property Relief (BPR) thresholds will be increased from £1 million to £2.5m in a small victory to save Britain's family farms.

Just two days before Christmas, the Government has confirmed that family farm businesses below the £2.5m threshold could receive 100% relief when Inheritance Tax changes are expected to be introduced on April 6.

LISTEN NOW:

Defra has also confirmed that spouses or civil partners will be able to pass on up to £5m in qualifying agricultural or business assets between them.

According to the Government, the number of estates affected by the changes to APR in 2026-27 will halve from 375 to 185, adding that it could save farming families 'hundreds of thousands of pounds'.

And the number of estates affected by the reforms, which only claim BPR, will fall by a third, the Government claims, which could reduce 'complexity' and ensure 'support goes where it is needed most'.

Around 85% of estates claiming APR and BPR property relief in 2026-27, are forecast to pay 'no more' Inheritance Tax on their estates.��

Defra Secretary Emma Reynolds said the Government has listened and engaged with the sector, adding that it now wants to 'protect more family farms' by raising the thresholds, while arguing that the 'most valuable' agricultural and business assets should pay Inheritance Tax.

"�������� are at the heart of our food security and environmental stewardship, and I am determined to work with them to secure a profitable future for British farming," Ms Reynolds added.��

"We have listened closely to farmers across the country and we are making changes today to protect more ordinary family farms.

"We are increasing the individual threshold from £1m to £2.5m which means couples with estates of up to £5m will now pay no Inheritance Tax on their estates.��

"It is only right that larger estates contribute more, while we back the farms and trading businesses that are the backbone of Britain's rural communities."

PLEDGE YOUR SUPPORT: Join �������� Guardian's Save Britain's Family Farms campaign

MPs will have the chance to debate Inheritance reforms again next month as the Finance Bill reaches committee stage.

CLA president Gavin Lane the concession has been made after 'intense' lobbying from the sector, but he added the changes do not go far enough in reversing a 'damaging' policy.

"This change will come as an enormous relief to thousands of family farms across the country who faced seeing their businesses taxed out of existence," Mr Lane added.

"The Government deserves credit for recognising the flaws in the original policy and changing course.

"However, this announcement only limits the damage – it does not eradicate it entirely.

"Many family businesses will own enough expensive machinery and land to be valued above the threshold, yet still operate on such narrow profit margins that this tax burden remains unaffordable.

"On that basis, we thank Ministers for the constructive dialogue, we look forward to working in partnership to grow the rural economy, whilst continuing to call for these reforms to be scrapped entirely."

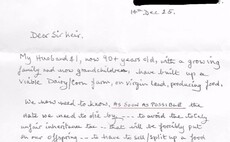

NFU president Tom Bradshaw said changes will come as a 'relief' to a lot of farming families after a prolonged period of campaigning to mitigate the worst impacts of a 'disastrous' policy.

"While there is still tax to pay, this will greatly reduce that tax burden for many family farms, those working people of the countryside," Mr Bradshaw added.

"Changes to APR and BPR announced in last year's Budget came as a huge shock to the farming community.

"Until that moment, the best tax planning advice was to hold on to your farm until death and pass it on to the next generation who could continue to run a viable farming, food producing business.

"The original changes to APR and BPR, contained within the Finance Bill, resulted in a pernicious and cruel tax, trapping the most elderly and vulnerable people and their families in the eye of the storm.

"The NFU and its members have stood strong for what we believed in.

"I am thankful common sense has prevailed and Government has listened."

Mr Bradshaw has praised the tole of the Defra Secretary in lobbying for change on the issue.

"She has played a key role underlining the human impact of this tax," he added.

"These conversations have led to today's changes which were so desperately needed.

"From the start the Government said it was trying to protect the family farm and the change announced today brings this much closer to reality for many.

"I would like to thank the Prime Minister for recognising the policy needed amending and the Chancellor for bringing in the spousal transfer in the Budget. Combined, this is a significant change."

The NFU president has paid tribute to farmers, growers, and MPs for their efforts in backing the campaign to stop the family farm tax over the past 14 months.

Mr Bradshaw said: "We have stood together and supported one another when it really mattered. In the end, it was a well-reasoned and rational argument that won through.

"I would like to thank all those Labour backbench MPs that were contacted by farmers and growers and decided to stand by their constituents as demonstrated by the recent abstentions on the vote on Budget Resolution 50.��

"While small in number, it was a significant and brave move for many.

"We have spent the past year working with them and there's no doubt their interventions behind the scenes have also played a huge role in securing today's news.

"I would also like to thank all opposition parties for continuously raising the impacts of this proposed policy.

"Finally, I would like to thank the public for supporting our campaign. More than 270,000 people supported our calls for change because they value British food and the working people of the countryside that produce it.

"It has been a very challenging year for many, but I hope we close 2025 with optimism for the future and an ability to work in partnership with all departments across Government to see British farming thrive."

TFA chief executive George Dunn said the changes will be a massive relief for farmers and will bring hope to many farming families up and down the country.

"The new threshold better reflects the average value of agricultural businesses across the country and with spousal transfers, where available, will bring the zero-rate band up to £5m," Mr Dunn added.

"Nevertheless, we believe there is unfinished business in respect of Inheritance Tax changes on traditional estates which are asset rich but cash poor and will have estates with market values well above the increased threshold, even with spousal transfers.

"Although they too will benefit from the changes announced today, we need these estates to be further encouraged to let secure agricultural tenancies to new entrants and progressive farmers to drive the profitability and environmental performance of our farming sector.

"We will therefore continue to ask for concessions for landlords who are letting tenancies on a secure basis including Farm Business Tenancies for 10 years or more."

Scotland

NFU Scotland president Andrew Connon said the Government's concessions represent a 'significant day' for the future of Scottish agriculture.

Mr Connon says: "The changes set out by the UK Government is a victory for common sense and reflects 14 months of relentless lobbying from NFU Scotland and the other UK Farming Unions in our pursuit to mitigate the worst of the impacts of the policy and protect our family farms.

"While there is still tax to pay, this will greatly reduce that tax burden for many family farms, those working people of the countryside.��

"This has been a monumental effort from the entire team at NFU Scotland, including from thousands of members the length and breadth of the country who have shown incredible resilience, strength, and solidarity in response to the original ill-conceived proposals.

"I am incredibly grateful to all our members for their unwavering support during the past 14 months, during which time they have got involved in lobbying, rallies, and direct engagement with the public to raise awareness of our campaign.

"I am also grateful to those many Scottish politicians who have supported our campaign directly and those who have engaged and listened to our pleas for common sense to prevail.

"A particular thanks must go to Alistair Carmichael MP, the Chair of the EFRA Committee, for his guidance and support throughout the entire campaign."

Mr Connon said after months of campaigning, which has been emotional and draining for many, the concessions will be cause for a small celebration across the farming industry in Scotland.

He added: "There are no doubt still tough times ahead for our farmers and crofters as we continue to navigate many wider challenges, but NFUS remains hugely optimistic for the future and today's announcement has increased that belief further."

Northern Ireland

UFU president William Irvine said the Government U-turn represents a 'step in the right direction' for farming families, leaving the industry in a better position than it was yesterday.

However, he has stressed that the outcome is still not ideal for everyone.��

"The UFU have lobbied tirelessly in opposition to the devastating Inheritance Tax proposals since they were announced in the 2024 Autumn Budget, and we are very relieved that those efforts were not in vain", Mr Irvine added.

"We have led a unwavering campaign in collaboration with the UK farming unions, highlighting the devastating consequences the Inheritance Tax changes would have on farming families, especially those here in Northern Ireland with our unique farming structure.

"The Government's decision to go ahead with the Inheritance Tax proposals was a shock to us all, but thankfully the sincerity and courage of our farm families who stood up and shared intimate fears for their farm has finally rung through.

"The strength and resilience of our farming community has brought this change and the UFU wish to thank each and every farmer who played their part.

"We stood as a united force, determined to make a difference, and showed the Government that they need to support and protect local food production and farming. It shows what can be done when we work together."

There is still a lot of work to do, the UFU president added.

"We will continue to lobby for the full reversal of family farm tax in the longer term. We have made huge progress, but there is more to be done," Mr Irvine added.

"For now, this year has been an immense challenge for our local farmers, and hopefully this news will lift a weight off the shoulders of many families, allowing them to enjoy a peaceful Christmas and a prosperous new year."

Wales

FUW President Ian Rickman said the concession is an 'early Christmas present' for farming families.

"Today's news will be a welcome early Christmas present for many farmers across Wales who have endured months of uncertainty and anxiety caused by the UK Government's ill-thought-out changes to Inheritance Tax" Mr Rickman added.

"The Government's initial proposals for IHT reform caused untold worry for farming families, and have seriously dampened confidence across the sector and wider rural economy, as farmers have feared for the long-term succession of their businesses.

"At a time of considerable uncertainty and volatility for farmers across Wales, the UK Government's revisions to the tax threshold represent some much-needed relief.��

"Though the FUW remains frustrated with the way the UK Government has approached these reforms, I would like to offer my thanks to Ministers in the Wales Office for their willingness to engage in dialogue with us on this issue to date."

NFU Cymru president Aled Jones said has praised the tireless efforts of the entire industry to amend the family farm tax.

"This is a major development which will take many Welsh family farms above the threshold for Inheritance tax and will greatly reduce the tax burden for others," Mr Jones added.

"When it became clear that we were not going to get rid of the proposals announced in the October 2024 budget NFU Cymru, alongside our colleagues in the NFU, NFUS and UFU, have left no stone unturned in lobbying for changes that would mitigate the worst elements of the original proposals.��

"Today's announcement alongside the changes in the November budget will be very welcome news to many Welsh family farms, coming as it does just before Christmas, a time when families come together.

"I would like to thank all our NFU Cymru members for their diligent and consistent lobbying of MPs, often having to share tragic and upsetting deeply personal stories with politicians and the media.

"I would like to thank the supply chain who stood by us throughout, recognising the damage that the original proposals would have caused not just to family farms but to rural Wales.

"The public have also been fantastic."

NFU Cymru said Labour rural MPs deserve credit for their efforts in securing what could be 'important' changes for the sector.

"We must also recognise the Welsh Labour MPs who were willing to meet with us and hear first-hand the human impact the original proposals would have had on farming families, who have stood up for their constituents and backed Welsh farming and rural Wales, and who in recent weeks demonstrated their support for our campaign by abstaining from the Budget resolution 50.��

"We owe our gratitude to them for helping the UK Government make the changes needed.

"I would like to thank the UK Government for recognising that the original proposals would have caused untold damage to Welsh and British farming and for making the changes they have, which are very much welcomed and will make a significant difference to family farms the length and breadth of the country."

Defra said the Government remains committed to making the tax system 'fairer' by reducing the 'generous' Inheritance Tax reliefs available to owners of large agricultural and business estates, while continuing to recognise the importance of farms and businesses to local communities and the wider economy.

However, the Government added that 'costings' for today's announcement will be incorporated into the next OBR forecast.����

READ NOW:��Abstaining from IHT vote sent Gov 'powerful message' to rethink policy, Labour MP says

![EXCLUSIVE - Tom Bradshaw: "My message to him [Sir Keir Starmer] was simple: there is still time to take action to remove those most at risk from the eye of this storm"](https://image.chitra.live/api/v1/wps/fa44383/6308f33a-fc0d-4399-85be-6079177beeaa/3/170125-tom-bradshaw-7802635-323x202.jpg)