Scottish Land & Estates (SLE) has said today's UK Budget offers little meaningful support to unlock the growth potential of rural Scotland.

Mileage-based charge on electric vehicles

In the Budget, the Chancellor confirmed a new mileage-based charge on electric vehicles from April 2028 – a change that will fall disproportionately on rural motorists, who typically depend on longer car journeys due to limited public transport options.

Also included was a reduction in the corporation tax writing-down allowance (WDA) main rate from 18% to 14% from April 2026 – a move the OBR has warned could slow investment.

SLE expressed particular disappointment that the UK Government has made no concessions on its proposals to increase inheritance tax on agricultural and other business property, other than to allow the £1 million threshold to transfer between spouses, with changes still set to come into effect on 6 April 2026.

Cameron Gillies, head of external affairs at Scottish Land & Estates, said: "This is a Budget that offers very��little for rural Scotland.

"Rural Scotland has enormous economic potential that is ready to be unlocked, yet the UK Government continues to reach for higher taxes rather than policies that stimulate growth. There is almost nothing in today's announcement that will encourage fresh investment into rural areas.

Rural motorists

"Rural motorists – who often have no alternative but to travel long distances – will be hit hardest by the new mileage-based tax on electric vehicles. While we welcome the fuel duty freeze until next September, the EV mileage change risks discouraging the very transition to EVs that government wants to see.

"The cut to the writing-down allowance is expected to raise £1.5bn for the Exchequer, but only by slowing down essential investment, particularly in new equipment and machinery. It is yet another example of reliefs being steadily eroded – down from 25% in 2009 – at a time when businesses need certainty and support.

"There is also very little in this Budget to support SMEs – the backbone of rural Scotland's economy. Rural areas have a higher proportion of small employers and non-corporate businesses, particularly family farming partnerships and trusts. Yet these are precisely the business structures excluded from the few remaining incentives aimed at ‘business', such as full expensing for capital allowances. The Chancellor has failed to recognise the disproportionate disadvantage facing rural SMEs. This can only widen the rural-urban economic divide and constrain the national economic growth that government says it wants to deliver.

"The farmer protest at Westminster today underlines the deep frustration across the sector about the government's approach to inheritance tax on agricultural and other business property. While we welcome confirmation that the £1 million inheritance tax threshold will be transferable between spouses - a measure we argued for - the wider process has been characterised by a lack of listening and meaningful engagement with rural businesses."

Ulster �������� Union president William Irvine: "The main takeaway from the budget is that the Labour government have not listened to our agricultural industries lobbying over this last 12 months. There was a very tiny crumb of comfort in the fact that they made the million pound relief transferable between spouses.

"But the main impact of last year's budget remains in place and will be devastating on many UK farms.��

"At this point, all our focus is being directed towards a possible amendment to the finance bill in the coming weeks. But at farm level, there will be a lot of intense conversations between legal advice and accountancy advice as to how our guys can protect their business.

"One thing they could have done was made some sort of an allowance for the very elderly and the terminally ill and they were that hard-hearted, they didn't even look at that."

More than 275,000 members of the public have called on the government to make changes; trade associations representing 160,000 family businesses wrote to the Chancellor calling for reform to the policy; MPs from across the political divide have told the Chancellor about the impact it will have on the rural communities they represent; and independent tax experts have suggested changes to make it more targeted.

The Chancellor announced a small change to the rules which will allow those farmers who are married, or have deceased spouses, to transfer their inheritance tax allowance to one another if one of them dies having not used their allowance.

NFU President Tom Bradshaw said: "It is good to see the government accepts its original proposals were flawed. But this change goes nowhere near far enough to remove the devastating impact of the policy on farming communities.

"It is only right that agricultural allowances can be transferred between spouses and it is something we have been calling for, but it does not go anywhere near far enough in protecting the working people of the countryside. It does nothing to alleviate the burden it puts on the elderly and vulnerable.

"It is also��a huge��smack in the face to the Labour MPs who have been working so hard to find a way through this for their local farmers.��To them, we say thank you.

"The Chancellor said she wanted to ‘back working people not make them poorer' and to ‘increase investment not cut it'. To do that, government must look again at the multiple solutions that have been put forward by industry and tax experts.

Increase in the National Living Wage

"Several other announcements in the Budget will hit farming and growing businesses hard. The increase in the National Living Wage, which will have risen 12% in two years, puts further cost pressures on agricultural and horticulture businesses and further inflationary pressures on our food system. At a time when the government has an ambition to get the country eating more fruit and vegetables, it will hit the horticulture sector hardest.

"The increase in the autonomous tariff quota (ATQ) for sugar cane undercuts British growers at a time when this government says promoting growth and investment at home is its priority.

"However, we believe farming may benefit from the announcements on apprenticeships and it could help bring the next generation into our food and farming sector. ��

"Public support over the past year has been incredible. We will need this support to continue from all sides to create the change needed to protect those people caught up in this unjust, unfair policy. The fight continues; we cannot give up and we will work with the wider industry, supply chain and MPs on next steps."

Extending Frozen Thresholds

Sean McCann, chartered financial planner at NFU Mutual said:��"The Chancellor's decision to extend the freeze on Income tax thresholds for a further three years will see an increasing number caught in the ‘60% tax trap'.

"Introduced in 2010, it sees anyone with an income of over £100,000 lose £1 of their tax-free personal allowance for every £2 of income over £100,000, resulting in a 60% tax charge on income between £100,000 and £125,140.

"This further freeze will mean that the £100,000 threshold will not have moved for twenty years. Had it been revalued by CPI it would now only catch those with incomes over £154,000.''

National Insurance to be applied on contributions to salary sacrifice schemes above a £2,000 per year threshold

Martin Ansell, pensions expert at NFU Mutual��said: "Applying National Insurance on contributions to salary sacrifice schemes above a £2,000 per year threshold is another disappointing tinkering to the pensions system.

"It will discourage some employees to save into their pension and weaken employer's sponsorship of quality arrangements at a time when people are already generally not saving enough for their retirement and who, therefore, may represent a potential burden on future taxpayers.

"Depending on their level of contribution and their employer's reaction, some employees are likely to see their take home pay reduced.

"For businesses where it hits their bottom line, it will reduce the amount they have for future investment and/or hiring new staff.

"At least the three-year delay to April 2029 will give administrators of such schemes more time to deal with this complexity, while encouraging some higher pension contributions in the meantime."

The announcement that 100% IHT relief can be transferred between spouses is a 'positive note' and so far no changes have been made to lifetime gifting rules.

Sarah Jordan, Real Estate, Landed Estates and Farming, Rural Services, Moore Barlow said: "Following today's Budget, farmers will be disappointed that the level of APR and BPR has not been increased from decisions made last year, and 100% relief will be capped at £1m still, and relief at 50% thereafter.

"However, on a more positive note, it is good news that the 100% relief can be transferred between spouses, enabling £2m to be rolled over and applied on second death. ��Also, no changes so far as we can see that have been made to rules of lifetime gifting including the availability of holdover relief for CGT purposes."

The announcement sees any unused allowance for the 100% rate of relief to be transferable between spouses and civil partners from April 6, 2026.����

Lisa Millington, HCR Law said: "This is a small, but helpful, concession. It will not reduce the amount of tax ultimately payable by a farming family, but will help slightly with the succession planning practicalities for some families."

Tenant �������� Association (TFA) chief executive George Dunn said: "We welcome the concession announced in today's Budget that the new £1 million zero rate threshold for Agricultural and Business Property Relief from Inheritance Tax to be introduced from next April will be transferable between spouses and civil partners.��

"However, that is only one of six reasonable asks tabled by the Tenant �������� Association to the Inheritance Tax changes she announced in 2024.

"It is hugely frustrating that the Chancellor did not engage with the farming community to debate her policies and to take account of the full package of measures that would both enhance the ability of the Government to meet its public policy objectives and diminish the damaging impacts on farm businesses and farm families.

"Sadly, the Chancellor has run scared from meeting farmers and their representative bodies to debate her policies, and she continues to block that engagement.��

"At the same time as farmers were being arrested for peacefully protesting against her taxation changes, just a stone's throw from Parliament, her failure to adequately address their legitimate concerns in her Budget statement is lamentable.

"The Chancellor has one further opportunity to redeem herself by comprehensively amending the draft Finance Bill legislation before she tables it for debate in Parliament and I strenuously urge her to take it.

"Additionally, it is hugely disappointing that we have not seen any movement on the operation of Stamp Duty Land Tax as it impacts much needed longer-term tenancies nor on the rules around Universal Credit which discriminates against farmers who work long hours for low returns.

"�������� and farm families will, once again, feel largely unheard and misunderstood by this Chancellor of the Exchequer and the TFA will be continuing to lobby for that to change."

Opposition Leader Kemi Badenoch responds to the Chancellors Budget.��

Ms Badenoch says Ms Reeves should be on the side of the farmer 'like the Conservatives are'.��

View this post on Instagram

Scottish Conservative MP for Gordon and Buchan Harriet Cross joined farmers on the streets of London ahead of the Budget announcement to underline the damage that has already been caused by the tax rise.

"This is yet another dark day for the farming industry who are being put through hell by this Labour government," she said.��

"Rachel Reeves had the chance to fix the damage that Labour have caused, but instead she has sold out the industry which could signal the end for rural businesses.

"The Chancellor's decision not to axe this tax will change the future of family farming forever – not for the better – but for worse.

"The industry is contending with one of its toughest periods in living memory, and next April will make survival even harder.

"Rachel Reeves should be ashamed of her decision to use farmers as a pawn to claw back money for her mistakes."

In England properties worth more than £2m will face a £2,500 annual charge, rising to £7,500 for properties worth more than £5m.��

Basic rate of Income Tax or National Insurance will not increase.����

RPI inflation increase to alcohol duty.

The Scotch Whisky Association (SWA) has responded to the Chancellor's decision to further increase duty on Scotch Whisky, saying that it will put 'additional pressure on a sector suffering job losses, stalled investment and business closures'.

Mark Kent, chief executive of the SWA said: "The Scotch Whisky industry is disappointed that the domestic tax burden has once again increased in the Autumn Budget, putting huge additional pressure on a sector suffering job losses, stalled investment and business closures.

"Put simply, the government cannot expect the Scotch Whisky sector to just keep delivering growth, both at home and on the world stage, if the conditions which support growth are not nurtured.

"The previous��3.65% increase to spirits duty has reduced spirits revenue by 7% - a loss to the Treasury of�� £150m. Hiking duty today, for the third time in two years, not only limits our sector's ability to contribute to much needed economic growth and productivity, but will once again fail to deliver for the public purse and needlessly cost jobs.

"Increasing global and domestic pressures led our industry to ask for duty in our home market to remain unchanged. Not a tax cut, not a handout, simply breathing room for a critical Scottish industry. Government has chosen to ignore those warnings, to the detriment of distillers, of bars and restaurants, our farmers and suppliers, and ultimately of growth."

The Chancellor's mention of changes to Inheritance Tax made in the previous years Budget ignited jeers across the House of Commons.

Simon Gooderham, managing partner, Cheffins comments: "It is a major disappointment that the Government has not made a U-turn on, or even softened, its latest announcement this afternoon regarding Inheritance Tax and in particular, Agricultural Property Relief.

"The financial and mental strain on the agricultural sector has been immense, with the combination of the tapering out of the Basic Payment Scheme and the dwindling numbers of farm subsidies and environmental grants.

"The £1m cap on relief has created worrying times for the entire agricultural community, and as a result, it is anticipated that more farmland will be offered for sale as farmers try to offset individual tax liabilities.

"This aggressive policy approach by the Government to IHT will likely mean that a number of active farms will be swallowed up within the next generation, creating a bleak future for many family farms and rural communities across the country.

"Forward planning with appropriate professional advice and support At will be critical to help farmers navigate their way through this disastrous policy."

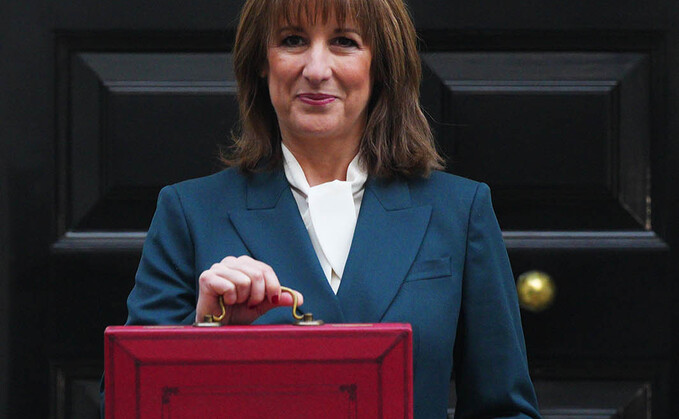

The Chancellor has left Downing Street with her red box. She will now make her way to the House of Commons, where she will deliver the Budget.��

During her departer, farmers gathered to boo her and sound their horns.����

View this post on Instagram

During Prime Ministers Questions (PMQ's), opposition leader Kemi Badenoch criticises the decision's of Rachel Reeves by pointing out the farmers protests outside.��

At 12:30pm today (November 26), Chancellor Rachel Reeves will announce the Autumn Budget 2025 which has farmers on the edge of their seats waiting to see what she has in store for the industry.

Many have urged the Government to raise the Inheritance Tax threshold which currently sits at £1 million, so that smaller farms will not be impacted.��Ministers have said, however, that no APR and BPR changes will be made, and at the recent CLA conference Farming Minister Dame Angela Eagle said,��‘we are where we are on that one and we have got to look forward', and the industry must move on.��

Now farmers gather outside Westminster awaiting the announcement.��

READ MORE:��What can farmers expect from the Autumn Budget 2025?